Key Findings:

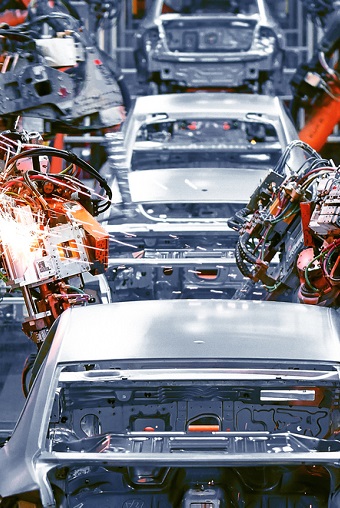

A complete market research report, including forecasts and market estimates, technologies analysis and developments at innovative firms within the Manufacturing, Automation & Robotics Industry. Gain vital insights that can help shape strategy for business development, product development and investments.

Key Features:

-

Business trends analysis

-

In-depth industry overview

-

Technology trends analysis

-

Forecasts

-

Spending, investment, and consumption discussions

-

In-depth industry statistics and metrics

-

Industry employment numbers

Additional Key Features Include:

Industry Glossary

Industry Contacts list, including Professional Societies and Industry Associations

Profiles of industry-leading companies

-

U.S. and Global Firms

-

Publicly held, Private and Subsidiaries

-

Executive Contacts

-

Revenues

-

For Public Companies: Detailed Financial Summaries

-

Statistical Tables

Key Questions Answered Include:

-

How is the industry evolving?

-

How is the industry being shaped by new technologies?

-

How is demand growing in emerging markets and mature economies?

-

What is the size of the market now and in the future?

-

What are the financial results of the leading companies?

-

What are the names and titles of top executives?

-

What are the top companies and what are their revenues?

This feature-rich report covers competitive intelligence, market research and business analysis—everything you need to know about the Manufacturing, Automation & Robotics Industry.

Plunkett Research Provides Unique Analysis of the Following Major Trends Affecting the Manufacturing, Automation & Robotics Industry

-

Major Trends Affecting the Manufacturing, Automation & Robotics Industry

-

Introduction to the Manufacturing, Automation & Robotics Industry

-

Industrial Robots and Factory Automation Advance Through Artificial Intelligence (AI)

-

Humanoid Robots/Service Robots Are Boosting Efficiencies in Warehouses and More

-

Tariffs Impact Manufacturing of All Types/Imports from the EU, China, Mexico and India Affected

-

U.S. Electric Vehicle (EV) Subsidies Expire in 2025/U.S. Auto Manufacturers Change Strategies

-

Global Growth in Manufacturing and Trade Require Investment by Emerging Nations

-

Introduction to the Outsourcing & Offshoring Industry

-

Pros and Cons of Outsourcing & Offshoring

-

Nearshoring and Reshoring Keep Operations Closer to Home

-

U.S. Apparel and Textile Jobs Reshore to Some Extent

-

Vietnam, India and Other Countries Gain Manufacturing Market Share/Tariffs Alter Market Significantly

-

The Vast Majority of Shoes Sold in the U.S. Are Made Elsewhere

-

3-D Printing and Robotics Revolutionize Manufacture of Shoes and Fabrics

-

Original Design Manufacturing (ODM) Adds Value to Contract Electronics Manufacturing

-

Trends in Manufacturing, such as Original Design Manufacturers (ODMs), Lead to Collaboration and Consulting-Like Services

-

3D Printing (Additive Manufacturing), Rapid Prototyping and Computer Aided Design

-

3PL Logistics Services and Supply Chain Management Services Evolve and Consolidate

-

Manufacturers Focus on High Performance Plastics and Specialty Chemicals

-

Refineries Along with Chemicals and Plastics Plants Expand in the U.S.

-

Telecom Equipment Makers Face Intense Competition from Manufacturers in China

-

Boeing and Airbus Compete for New Orders

-

U.S. Auto Manufacturers Ford, Stellantis and GM Compete Head-On with Foreign Manufacturers

-

India Has a Significant Automobile Market, with Great Long-Term Potential

-

Mexico Is a Leading Automotive Maker and Exporter

-

Designers and Manufacturers Bypass the Middleman with Direct-to-Consumer Online Business Models

-

Artificial Intelligence (AI), Deep Learning and Machine Learning Advance into Commercial Applications, Including Health Care and Robotics

-

The Internet of Things (IoT) in Factories, Robotics and Equipment

-

Health Care Robotics

-

Robotics in Retailing and Ecommerce Fulfillment

Plunkett Research Provides In-Depth Tables for the Following Manufacturing, Automation & Robotics Industry Statistics

I. Overview of the Manufacturing, Automation & Robotics Industry

-

Manufacturing, Automation & Robotics Industry Statistics and Market Size Overview

-

Sales & Net Income After-Tax, U.S. Manufacturing Corporations: 2016- 1st Quarter 2025

-

Sales & Operating Profits, U.S. Manufacturing Corporations, by Industry: 1st Quarter 2024- 1st Quarter 2025

II. Output & Employment

-

Value Added to U.S. Economy by Manufacturing Sector, as a Percentage of GDP: 1997-2024

-

Employment in the U.S. Manufacturing Sector, as a Percentage of all Private Industry Employment: 1950 – July 2025

-

Employment in the U.S. Manufacturing Sector, by Industry: 2019 – July 2025

-

Manufacturing Output vs. Employment, U.S.: 1980- June 2025

-

Gross Output in the Wood & Nonmetallic Mineral Products Manufacturing Industries: Selected Years, 2018-2023

-

Gross Output in the Primary Metals & Fabricated Metal Products Manufacturing Industries: Selected Years, 2018-2023

-

Gross Output in the Machinery Manufacturing Industry, U.S.: Selected Years, 2018-2023

-

Gross Output in the Computer & Electronic Product Manufacturing Industries: Selected Years, 2018-2023

-

Gross Output in the Electrical Equipment, Appliances & Components Manufacturing Industries: Selected Years, 2018-2023

-

Gross Output in the Motor Vehicles & Transportation Equipment Manufacturing Industries: Selected Years, 2017-2023

-

Gross Output in the Food, Beverage & Tobacco Product Manufacturing Industries, U.S.: Selected Years, 2018-2023

-

Gross Output in the Textile & Apparel Manufacturing Industries, U.S.: Selected Years, 2018-2023

-

Gross Output in the Chemicals, Plastics & Rubber Products Manufacturing Industries, U.S.: Selected Years, 2018-2023

III. Shipments

-

Annual Value of Manufacturers’ Shipments for Industry Groups, U.S.: 2018-2024

IV. Exports

-

Value of Exports of All Manufactured Goods, U.S.: 2018 – 2024

-

Exports of Durable & Nondurable Manufactured Goods, U.S.: 2018 – 2024

-

Value of Exports of U.S. Vehicles: 2019-2024

-

Exports, Imports & Trade Balance of Computers & Electronic Products, U.S.: 2018-2024

-

Exports, Imports & Trade Balance of Chemicals, U.S.: 2018 – 2024

-

Top 50 Destinations of U.S. Textiles & Apparel Exports: 2023-2024

-

Top Ten Suppliers & Destinations of U.S. Computers & Electronic Products: 2018- 2024